In this post, I will describe some practical ideas to reduce your cost of living.

Home

I, too, am a Korean person who lived witnessing the power of real estate, so I can understand people’s special obsession with homes. However, living in a small house, a frugal house, is the most important way to be thrifty and save. If you fail at this, everything else is useless. Someone said this: pennies saved up will still just be pennies in the end. If you spend a lot of money buying or renting a big house, it’s no use being thrifty in other areas. Get a house appropriate for your place in life. If you do this, you’ll have already achieved more than half of your goal to reduce your basic cost of living.

There are three more things I want to tell you in regards to homes:

The first is that “owning” a house is not always the best. A home is an expendable good (a concept I only understood after reading a book…). Going into debt trying to buy something expendable isn’t the American dream or the Canadian dream, but an ideology that only fills the belly of the banks. It’s fine if you can afford it and are doing it to diversify your investments, but going into excessive debt to buy a house is just making you live a life where you must hand over all your hard-earned money to the bank for the rest of your life. According to the books I’ve read, the average North American person gives one third of their lifetime earnings to the bank. So, can you guess who encourages people to buy a house the most? Of course, the real estate industry, insurance companies, builders, home repair contractors, etc. are a part of it, but ultimately, it’s the bank. When people get a mortgage and buy a house, that’s a lot of money in the bank’s pockets. Don’t work for the bank. Saving to buy expendables or not buying them at all is the most basic of the basic principles of personal finance.

The second thing is to take full advantage of the space of your current home (whether you own it or not). The key is getting rid of useless material things. They say you should throw away anything you haven’t used in over a year. I put this to practice and made a considerable amount of space for myself. Because a house is quite expensive, it’s foolish to fill it with things you don’t really use or things you think you might use one day, and getting rid of those things to have more usable space in your home just makes sense. And it will significantly reduce the need to move to a bigger home.

The third thing is that people who translate don’t need to live in an expensive area. A translator can live anywhere that has Internet. The quiet rural areas or small towns have good air, people with good hearts, cheaper prices, and most importantly cheaper housing and don’t have any transportation or parking problems. I’m sure everybody has special circumstances so there is no uniform rule to this, but I think this is something you should consider carefully over the long term.

Car

An important practical technique that the books I introduced in the previous post taught me was to never buy a new car. The market price of a new car nosedives the moment you drive it out of the dealership. The usage value of the car doesn’t drop so quickly, but the market price of the car drops mercilessly. I can’t really explain the concept in detail here, but I’m sure a lot of you know what I’m talking about. They say you should buy a low-mileage used car if you want to prevent yourself from sitting around losing a few hundred dollars a month. You can also buy a car from a car rental company; they service their cars after each use. If only I knew this ten years ago, I would’ve already saved tens of thousands of dollars….

Credit card

Although it seems like credit cards give us a variety of benefits, a lot of people are in fact stuck under the evil influence of the credit card. Naive ordinary people don’t have the power to resist the highly calculated marketing techniques that they use. When I use my credit card, I always pay off the full amount before the next payment date. Through that method, I’ve never once been charged with a credit card interest. That’s why I thought I was living fairly wisely in my own way.

However, after reading the books, it turned out that wasn’t really the case. It’s said that credit cards dull your senses so that you don’t know how much you’re making or spending, and also make it so that you don’t even have to know. Also, credit cards make you feel as if you have a lot of spendable money, which makes you overspend in the end. We were blinded by a small benefit and were getting hustled in a big way. In the end, the solution was to get rid of it altogether. I haven’t gotten around to actually enforcing this because I’ve set up so many automatic payments on my cards, but I will get rid of them before the end of the summer. (PS: Well, it turns out I can’t buy some things online without a credit card. So, I still have a credit card. Darn it.)

Bank fees

A bank is a place that conducts business with the money I entrust to them and still demands a fee from me for leaving my money with them. The more I think about it, the more ridiculous it seems. I have a friend who works at a bank, but I am very upset about banks. Someone said that a bank is a place that keeps pressuring you to borrow an umbrella when the sun is shining but then immediately takes back the umbrella the moment it starts to rain.

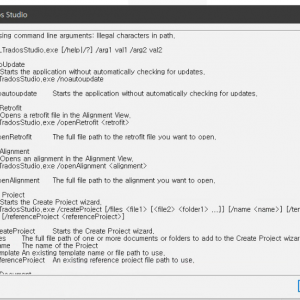

Despite the bank’s many persistent and clever gimmicks and pleadings, I changed all my financial transactions to online banking. It took a couple of months to do that, but once I did, everything was free. Even the checkbook. You will collect interest, even though it’s a small amount, for even the money in your checking account. So now, instead of the bank, it’s me with money in my pockets. Although it’s annoying, if you just make the effort once, you will save a couple hundred dollars a year.

A good accountant

When you file your tax report yourself, it feels like you’re saving around $200, doesn’t it? However, unless you’re an expert, nobody can understand and remember all the tax laws that change every year and apply them so as to benefit themselves. It’d be much more advantageous to just make more money in that time. If you choose a good accountant, he/she will find, claim, and apply so many benefits that you couldn’t even imagine, so that is the much better method.

Consumption

There are many reasons why people buy things, but you need to think about whether or not you’re buying something because you think it’ll make you happy instead of buying it because you really need it. Material things make false promises, and people continue to fall for the lies. Believe me, stuff can’t make you happy. Freedom, a life with principle and conviction, healthy self-esteem, consideration and kindness for other people — these are the things that will make you happy.

[bctt tweet=”Material things make false promises, and people continue to fall for the lies.” username=””]

[bctt tweet=”Believe me, stuff can’t make you happy.” username=””]

When I visited a house a few years ago, I saw that it became totally dysfunctional because it was overflowing with stuff. This is called a hoarding problem and it really broke my heart to see. I’m not a psychiatrist, so I didn’t have the skills to treat her…… Instead of buying stuff, buy freedom with words. I think that’s the life of a translator.

If you reduce your basic cost of living through the above methods, your life as a translator will become happier and you will have much more room to upgrade your business.